Cash Flow Problems: Because turning debt collector from salesman is not easy

By Roy Figueroa – Site Director, hammerjack

Originally published on LinkedIn

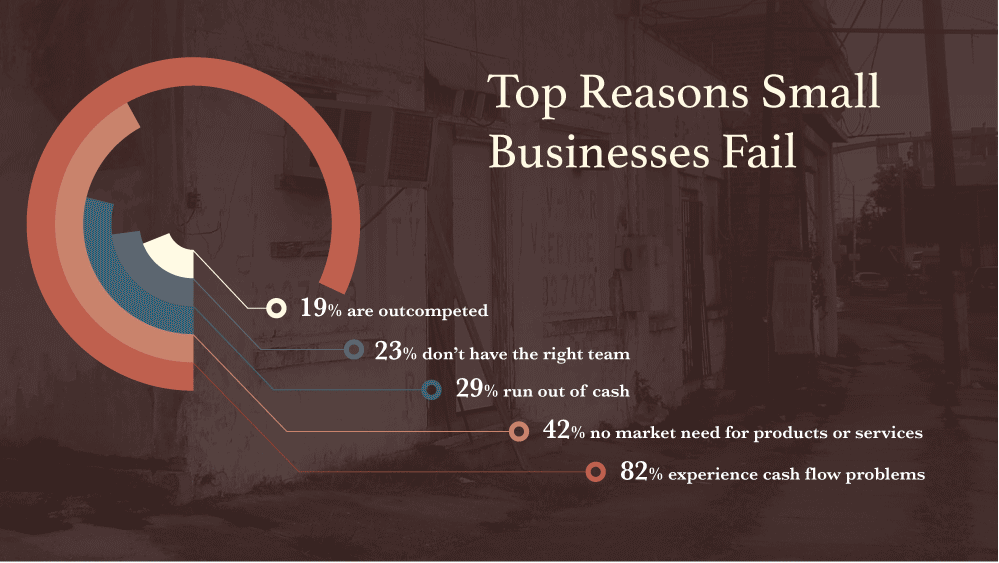

Whether in Australia, the US, or elsewhere in the world, studies have cited poor cash flow as a leading cause of business failures. ASIC’s report on corporate insolvencies show that 49% of the “nominated causes of failure” of businesses in Australia has been “inadequate cash flow or high cash use.” While in the US, a whopping 82% of small businesses fail because of cash flow problems!

While numerous cash flow management articles and courses are available, not enough people are talking about the value of managing AR (Accounts Receivable), specifically having a robust, consistent collections process, to a business’s survival.

When you “Sell, sell, sell” but only get paid, ___, paid.

It’s inevitable. Customers will encounter their own cash flow problems that will affect their ability to pay. However, how businesses react to this is totally within their control.

Oftentimes, especially in small and medium businesses, the business owner or account manager is also the guy who would have to send a reminder to the customer about their outstanding invoice. More often than not, it doesn’t happen.

Switching roles from being the salesman and solutions-provider to being the debt collector is not easy. It’s an awkward, embarrassing situation to be in which relegates the simple task of sending a payment reminder to the bottom of one’s list.

Create and AR Collections process and stick to it

In our years of providing Collections as a service, it no longer surprises me how the application of an uncomplicated, targeted AR Collections process can work wonders for businesses’ cash flow. We aren’t doing anything special, we’re just being consistent in our approach.

A collections process, one that outlines different actions taken depending on the aging of invoices and followed consistently month-over-month, removes the guess work for businesses and their customers. It does not solve your customers’ cash flow issues, but it ensures that their obligations to you remain front-of-mind, increasing the chance that your invoice is prioritized over others’ when cash becomes available.

To remove the awkwardness of having to switch roles (account manager to collector), a separate generic email address can be created e.g. accounts@business.com to send invoices and payment reminders. Outsourcing the AR Collections function to a provider who understands the value of relationships is also a good option as all efforts to collect can be professionally done whilst letting the business owner and account manager focus on selling and servicing customers.

Consistency is the key

In anything.

While businesses spend an enormous part of their time and resources in developing their products and selling, being consistent in dealing with its debtors is paramount to its survival and growth. Growth requires cash and getting paid is the most obvious way, not the easiest, to get cash.

Whether a business outsources its AR Collections or not, establishing a process and setting aside a small amount of effort, time, and money, to get paid is necessary.